Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

Key Insights for Investors and Buyers

Multifamily real estate is a solid investment for those looking to generate steady income and build long-term wealth. Unlike single-family properties, multifamily buildings provide multiple streams of rental income, which can help mitigate financial risks and improve overall returns. Whether you’re a first-time investor or looking to expand your portfolio, understanding the fundamentals of multifamily real estate is crucial. Here are five key things to keep in mind before making a move in this market.

1. Cash Flow Potential

One of the biggest advantages of multifamily properties is the ability to generate consistent and reliable rental income. Because you have multiple tenants paying rent, you’re less dependent on a single source of income, making your cash flow more stable compared to a single-family rental.

For example, if you own a four-unit apartment building and one tenant moves out, you still have income from the remaining three units, softening the impact of vacancies. This is a major reason why investors prefer multifamily properties—less downtime and a steady revenue stream can help cover mortgage payments, maintenance costs, and unexpected expenses.

2. Economies of Scale

Managing multiple units under one roof is often more cost-effective than owning several single-family homes. When all units are in the same location, expenses such as property management, maintenance, and utilities can be spread across multiple tenants, reducing overall costs.

For instance, instead of hiring separate landscapers, plumbers, or repair crews for multiple properties, you can consolidate these services for one building, lowering your per-unit maintenance cost. Similarly, if you employ a property manager, their fees for overseeing one multifamily building will typically be lower than managing several single-family homes scattered across different locations.

3. Financing Can Be Easier

While it may seem like financing a larger property would be more challenging, lenders often view multifamily real estate as a lower-risk investment compared to single-family homes. This is because the multiple rental units provide a built-in safety net—if one tenant stops paying rent, there are still other tenants generating income for the property.

As a result, banks and financial institutions may offer more favorable loan terms, such as lower interest rates and higher loan amounts. Additionally, government-backed loan programs, such as those offered by the Federal Housing Administration (FHA) and Fannie Mae, provide attractive financing options for multifamily investors, sometimes with lower down payment requirements.

4. Tenant Turnover and Management

With more units, the likelihood of tenant turnover increases. However, multifamily properties offer a key advantage: vacancies in individual units do not drastically impact your total revenue as they would in a single-family rental.

That said, effective tenant management is crucial. Finding quality tenants, handling maintenance requests, and ensuring lease renewals can become a full-time responsibility, which is why many investors hire property management companies. A good property manager can help streamline operations, keep occupancy rates high, and reduce the hassle of day-to-day responsibilities.

5. Market Demand and Location Matter

The success of a multifamily investment largely depends on location. Properties in high-demand rental markets—such as urban areas with job growth, universities, or strong public transportation networks—tend to attract tenants more easily and maintain higher occupancy rates.

Before purchasing a multifamily property, investors should research factors such as population growth, employment opportunities, and local rental demand. Understanding these trends can help identify locations with long-term potential and minimize the risk of vacancies.

Conclusion

Multifamily real estate offers numerous advantages, from steady cash flow and scalable operations to easier financing and risk diversification. However, like any investment, success depends on proper research, financial planning, and effective property management.

If you're considering investing in multifamily properties, start by analyzing potential markets, understanding tenant demand, and evaluating the financial viability of the property. With the right approach, multifamily real estate can be a powerful tool for building wealth and achieving long-term financial success.

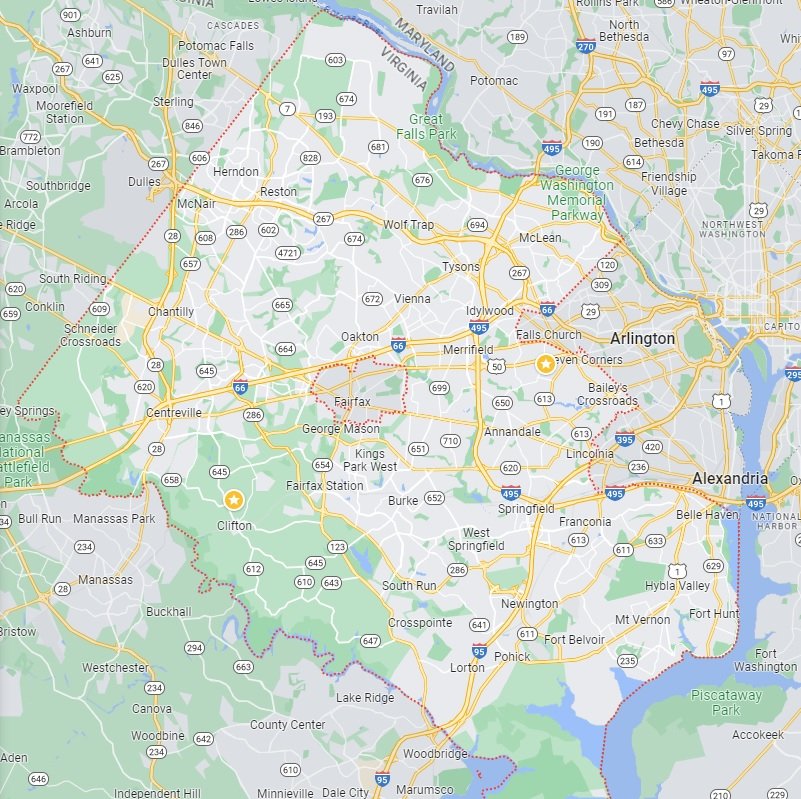

Fairfax County Homes for Sale

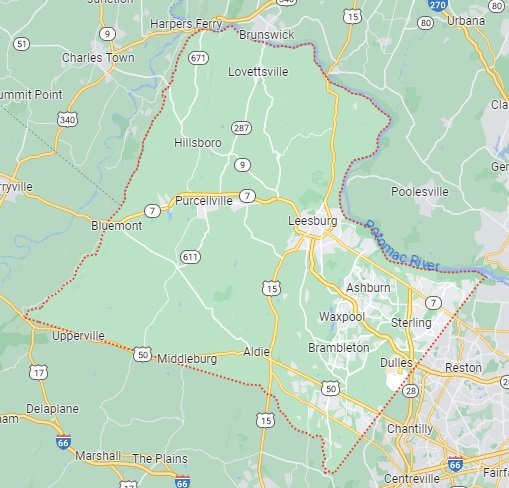

Loudoun County Homes for Sale

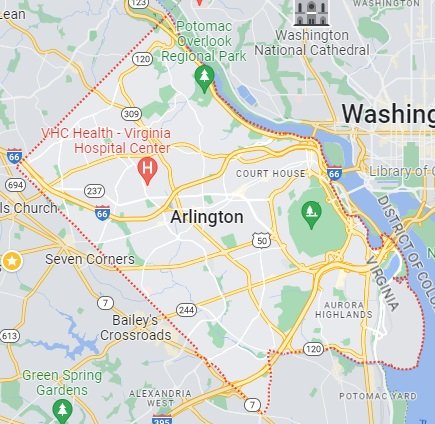

Arlington County Homes for Sale

Prince William County Homes for Sale