Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

TOP 3 PROS AND CONS OF INVESTING IN REAL ESTATE OR STOCKS

Investing in real estate and stocks are two popular ways to build wealth, and they each come with perks and things to consider. Usually, people tend to lean more into stocks because they think real estate has a higher barrier to entry than stocks. No matter what people pick, as long as they have the proper knowledge of investing, they will find success.

Considering your background, financial status, situation, goals, and risk appetite, the problem you could encounter is what investing avenue you would pick out of the two that would best suit you. Let's dive into the pros and cons of real estate and stocks to help you pick where to invest.

REAL ESTATE

Real estate involves owning property like houses, apartments, or commercial buildings. When you invest in real estate, you buy properties to make money through rental income, property appreciation, or both.

Pros

Appreciation - Unlike stocks, which represent company ownership and are subject to market volatility, real estate often appreciates steadily over time. This appreciation is driven by increasing demand for housing, population growth, and limited land supply in desirable locations. The great thing is that real estate values tend to be less correlated with stock market fluctuations, providing a hedge against economic downturns. Investors can also leverage their real estate holdings by financing purchases with mortgages, amplifying potential returns.

Easy To Learn - While the entire home buying process takes a lot of patience and effort, real estate is generally easier to learn than stocks because of its simplicity. You'll find a perfect home, purchase it, and either rent it out to tenants (if you have more homes than your residence) or sell it at a higher price in the future.

Tax Advantages - Real estate offers several tax benefits that can significantly impact an investor's bottom line. For instance, rental income from investment properties is often taxed at lower rates than ordinary income, and investors can deduct various expenses such as mortgage interest, property taxes, maintenance costs, and depreciation.

Cons

Expensive and Illiquid - Real estate investments often require substantial initial capital, including down payments, closing costs, and ongoing maintenance expenses. Additionally, real estate transactions involve lengthy processes, such as property inspections, appraisals, and title searches, which can further tie up funds and prolong investment timelines.

More Work Than Stocks - Unlike stocks, which can be passively managed through brokerage accounts or investment funds, real estate investments typically demand active involvement in property maintenance, tenant management, and dealing with various regulatory and legal obligations. This hands-on approach requires significant time, expertise, and resources, making real estate investment less suitable for individuals seeking a more hands-off investment strategy.

ROI Isn't Guaranteed - Real estate has historically offered attractive returns over the long term, so ensuring that a property will appreciate or generate positive cash flow is necessary. Various factors, such as economic downturns, changes in local market conditions, and unexpected expenses, can impact the profitability of real estate investments.

STOCKS

Stock represents ownership in a company and is typically bought and sold on stock exchanges. Investing in stocks involves purchasing publicly traded company shares to earn returns through capital appreciation and dividend payments.

Pros

Highly Liquid - Unlike real estate, which typically requires significant time and effort to buy or sell properties, stocks can be easily purchased or sold on stock exchanges with minimal delay. This liquidity allows investors to react to changing market conditions quickly, capitalize on investment opportunities, or rebalance their portfolios as needed.

Easier Diversification - Stocks allow investors to diversify their portfolios with relative ease across various industries, sectors, and geographic regions. This is because it requires less capital to buy a stock than it is to purchase real estate.

Lower Barrier To Entry - Investing in stocks typically requires less upfront capital than purchasing real estate properties, which often involve substantial down payments, closing costs, and ongoing maintenance expenses.

Cons

More Volatile Than Real Estate - Stocks are generally more volatile because you're relying on the performance of the company you're investing in.

Emotionally Driven Investing - Since stocks are much more liquid than real estate, your commitment to your investment is much less. Because of this, a highly volatile day can easily trigger your emotions, leading to wrong investment decisions.

Big Tax Payments - While stocks offer the potential for capital gains, these gains are typically subject to taxation at ordinary income tax rates if the stocks are sold within a year of purchase. This can result in higher tax liabilities for short-term traders or investors who frequently buy and sell stocks.

BOTTOM LINE

The bottom line is that real estate and stocks have pros and cons. Choosing what to invest in depends on your situation, financial status, goals, and risk appetite. But the most important of all is the knowledge you have in a specific investment avenue. The more knowledge you have, the more you'll succeed with what you choose to pursue because you'll know the obstacles to avoid and the best time to make decisions in your investment.

If you want to know more, feel free to reach out to me at (703) 562-1788 or Dan@greetingsvirginia.com. I’d be more than happy to show you around!

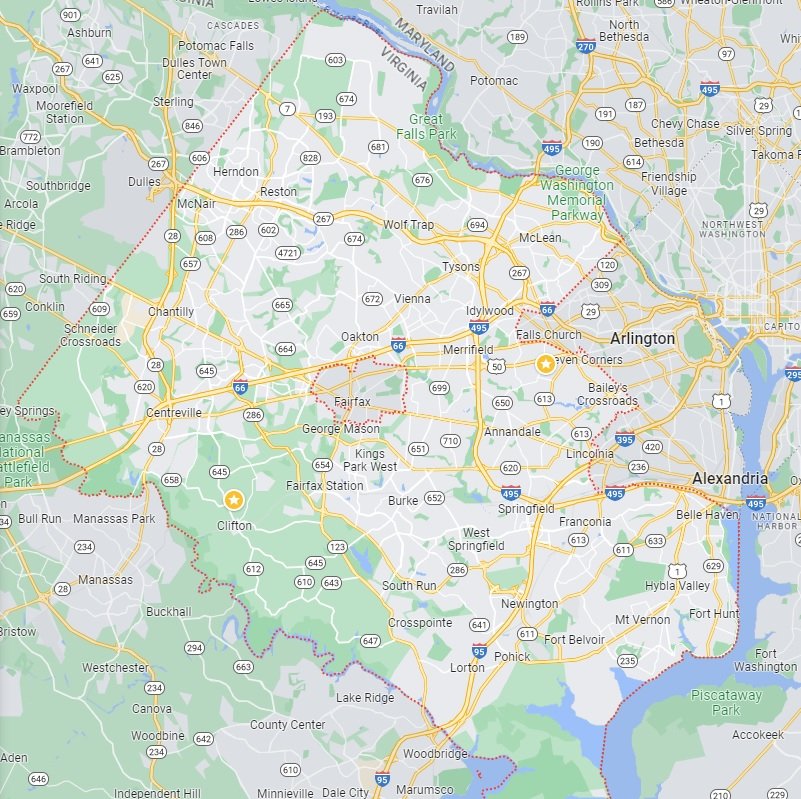

Fairfax County Homes for Sale

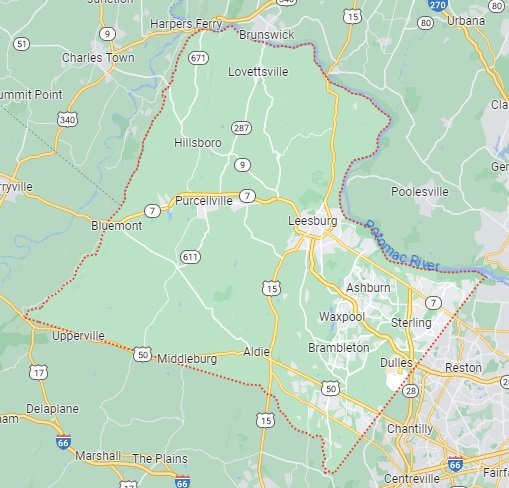

Loudoun County Homes for Sale

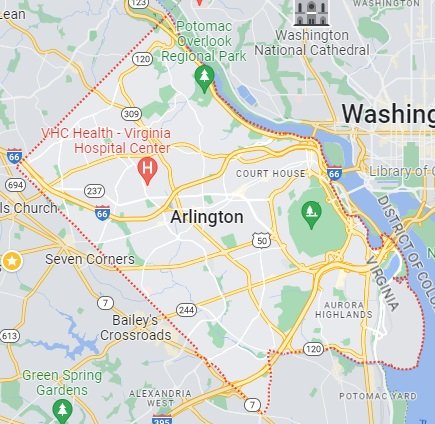

Arlington County Homes for Sale

Prince William County Homes for Sale